When it comes time to sell your home or investment property, one of the biggest financial questions is: How much will I owe in taxes? That’s where capital gains come into play. Understanding how to calculate capital gains can help you plan ahead, avoid surprises, and maximize the profit you keep. At Cin-Day Group Realtors, we guide homeowners across Cincinnati and Dayton through the selling process every day—and we’re here to break down how capital gains work, what affects them, and why they matter when you’re making real estate decisions.

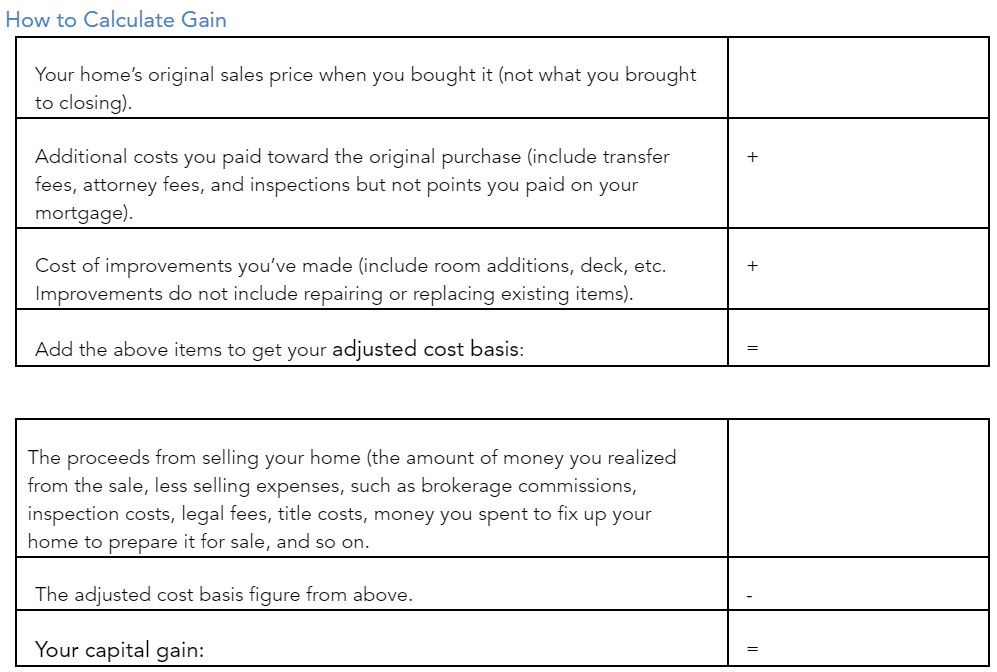

When you sell a stock, you owe taxes on the difference between what you paid for the stock and how much you got for the sale. The same holds true in home sales, but there are other considerations.

How to Calculate Gain

A Special Real Estate Exemption for Capital Gains

Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale. You may qualify for a reduced exclusion if you otherwise qualify but are short of the two-out-of-the-last-five-years requirement if you meet what the tax law calls “unforeseen circumstances,” such as job loss, divorce, or family medical emergency.

Selling real estate is about more than just the sale price—it’s about what you take home at the end. Knowing how to calculate capital gains ensures you’re fully prepared and making smart financial choices. If you’re thinking about selling in Southwest Ohio, the Cin-Day Group can connect you with trusted tax professionals and provide expert real estate guidance to make sure you get the most out of your investment. Contact us today to start planning your next move with confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link